Leaving A Legacy

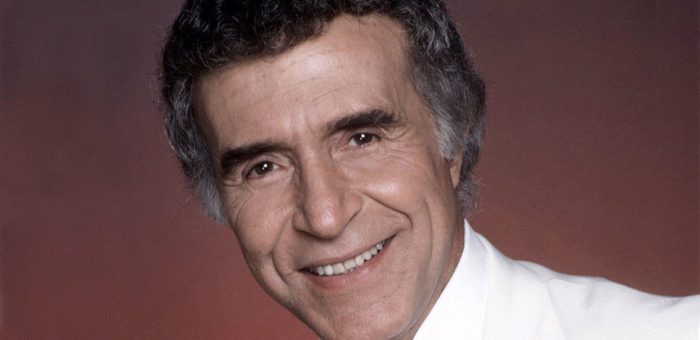

What will you pass on and be remembered by generations to come? If you ever go to Hollywood and Vine, just a half block from the Southeast corner stands a theatre bearing this man’s name. He overcame much adversity throughout his lifetime including racism and a crippling injury that eventually left him paralyzed from the waist down. A man whose career spanned over seven decades, on the stage, the big screen and even television where he performed a variety of genres, from crime and drama to musicals and comedy. Among his notable roles was Armando in the Planet of the Apes film series from the early 1970s, Mr. Roarke on the TV series Fantasy Island, and Khan Noonien Singh on the original Star Trek series and the film Star Trek II: The Wrath of Khan. An Emmy Award winner for…